M&T Bank Stock Outlook: Is Wall Street Bullish or Bearish?

/M%20%26%20T%20Bank%20Corp%20phone%20and%20data-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Buffalo, New York-based M&T Bank Corporation (MTB) operates as a bank holding company for Manufacturers and Traders Trust Company and Wilmington Trust, National Association, which provides retail and commercial banking products and services. Valued at $30.9 billion by market cap, the company offers a wide range of financial services, including commercial banking, mortgage finance, trust, wealth management, and investment services.

Shares of this leading regional bank have outperformed the broader market over the past year. MTB has gained 17.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14.3%. However, in 2025, MTB stock is up 5.3%, compared to the SPX’s 9.5% rise on a YTD basis.

Zooming in further, MTB’s outperformance is also apparent compared to the iShares U.S. Regional Banks ETF (IAT). The exchange-traded fund has gained about 10.6% over the past year. Moreover, MTB’s returns on a YTD basis slightly outshine the ETF’s 5.2% gains over the same time frame.

MTB's outperformance is driven by higher non-interest income, lower provisions, and growth in loan balances. Although expenses increased due to rising salaries, equipment, and software costs, the bank's solid net interest income and non-interest income are expected to drive organic growth, supported by decent loan growth and a diversified deposit base.

On Jul. 16, MTB shares closed down more than 2% after reporting its Q2 results. Its adjusted EPS of $4.28 beat the consensus estimate of $4.04. The company’s net interest income stood at $1.7 billion, a marginal decline from the year-ago quarter.

For the current fiscal year, ending in December, analysts expect MTB’s EPS to grow 11.1% to $16.53 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

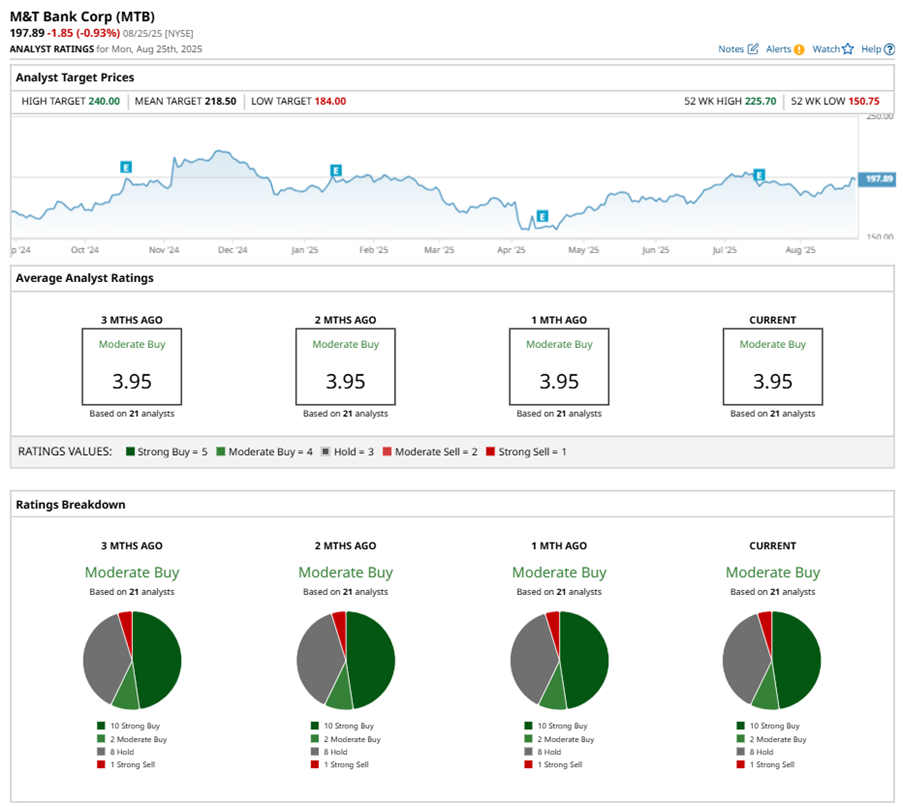

Among the 21 analysts covering MTB stock, the consensus is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings, two “Moderate Buys,” eight “Holds,” and one “Strong Sell.”

The configuration has been consistent over the past three months.

On Aug. 1, Andrew J Dietrich from JPMorgan Chase & Co. (JPM) maintained a “Hold” rating on MTB with a price target of $206, implying a potential upside of 4.1% from current levels.

The mean price target of $218.50 represents a 10.4% premium to MTB’s current price levels. The Street-high price target of $240 suggests an upside potential of 21.3%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.