Is AMD a Top Quantum Computing Stock to Buy Now?

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

Advanced Micro Devices (AMD) stock is in the spotlight this morning, up more than 2% in premarket trading after an upgrade to “Buy” at Truist Securities. In a note to clients, the brokerage firm said that AMD has graduated from its former status as a “price check” against rival Nvidia (NVDA), with hyperscalers now “expressing true interest in deploying AMD at scale.” Truist also hiked its AMD price target to $213.

Separately, AMD announced a new partnership with IBM (IBM) to develop quantum-centric supercomputing solutions. The two tech giants will integrate AMD’s CPUs, GPUs, and FPGAs into IBM’s quantum computers to help accelerate a new class of emerging algorithms.

"As we partner with IBM to explore the convergence of high-performance computing and quantum technologies, we see tremendous opportunities to accelerate discovery and innovation," said AMD CEO Dr. Lisa Su in a press release announcing the collaboration.

What’s the Outlook for AMD Stock?

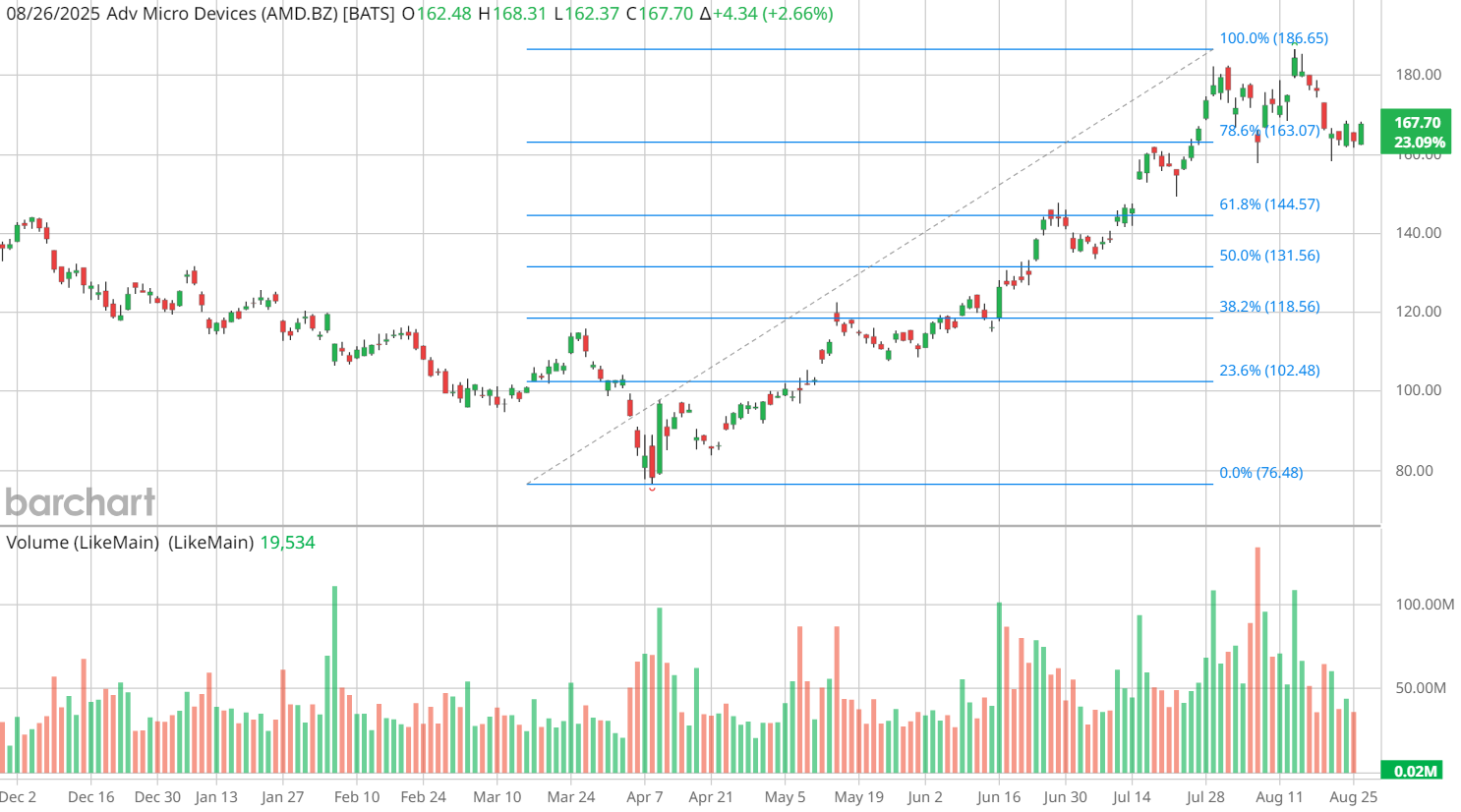

AMD has recently been consolidating around a 78.6% Fibonacci retracement of its recent high and low, with the shares up a staggering 113.6% since April. The semiconductor stock is still trading down about 28% from its all-time highs, set in March 2024.

At 1.36 times forward adjusted earnings, AMD isn’t particularly cheap at current levels, but the stock looks reasonably priced relative to its growth forecasts.

Currently, the company faces potential challenges in the form of geopolitical tensions and trade restrictions, particularly with the Trump administration's recent threats to increase tariffs on semiconductor exports. Despite these headwinds, AMD's strategic focus on data center and artificial intelligence (AI) capabilities appears to be gaining traction with industry analysts, indicating potential market share gains in these crucial high-growth sectors.

The company's market position is further strengthened by its ongoing CPU market share gains against Intel (INTC), supported by a 1% quarter-over-quarter increase in PC market shipments following a previously weak first quarter. In the broader semiconductor landscape, AMD stands to benefit from significant industry expansion, with global semiconductor market projections indicating growth from $34 billion in 2023 to $100 billion by 2032.

Is AMD Stock a Buy Right Now?

The semiconductor industry's ongoing transformation, driven by countries pushing for domestic manufacturing capabilities and technological sovereignty, presents both opportunities and challenges for AMD. That said, the company's strong positioning in emerging technologies, particularly in AI and quantum computing, combined with its strategic partnerships and technological advancements, suggests continued growth potential despite the rapidly developing (and occasionally uncertain) macro environment.

The average analyst rating for AMD stock is currently a “Moderate Buy,” and the mean price target of $187.30 suggests potential upside of 14.6% from Monday’s close. In the short term, options traders are anticipating a little extra excitement ahead of peer Nvidia’s Wednesday night earnings report, with AMD’s weekly August 29 series currently pricing in 52.15% implied volatility.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Elizabeth H. Volk had a position in: AMD , NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.